does colorado have inheritance tax

Inheritances that fall below these exemption amounts arent subject to the tax. Restaurants In Matthews Nc That Deliver.

Pittsburgh Skyline Love The View From Pnc Park Pittsburgh Skyline Pittsburgh City Monongahela

The good news is that since 1980 in Colorado there is no inheritance tax and there is no US inheritance tax but there are other taxes that can reduce inheritance.

. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40. However Colorado residents still need to understand federal estate tax laws. You should be redirected automatically to target URL.

Get an Estate Planning Checklist More to Get the Information You Need. An estate tax is imposed on the property before it is being transferred to heirs. Does Colorado Have An Estate Or Inheritance Tax.

Colorado Inheritance Tax and Gift Tax. You wont have to pay any tax on money that you inherit but the estate of the person who leaves money to you will be subject to an estate tax if the estates gross assets and any prior taxable gift amounts combined add up to more than 12060000 for 2022. It happens if the inherited estate exceeds the Federal Estate Tax exemption of 1206 million.

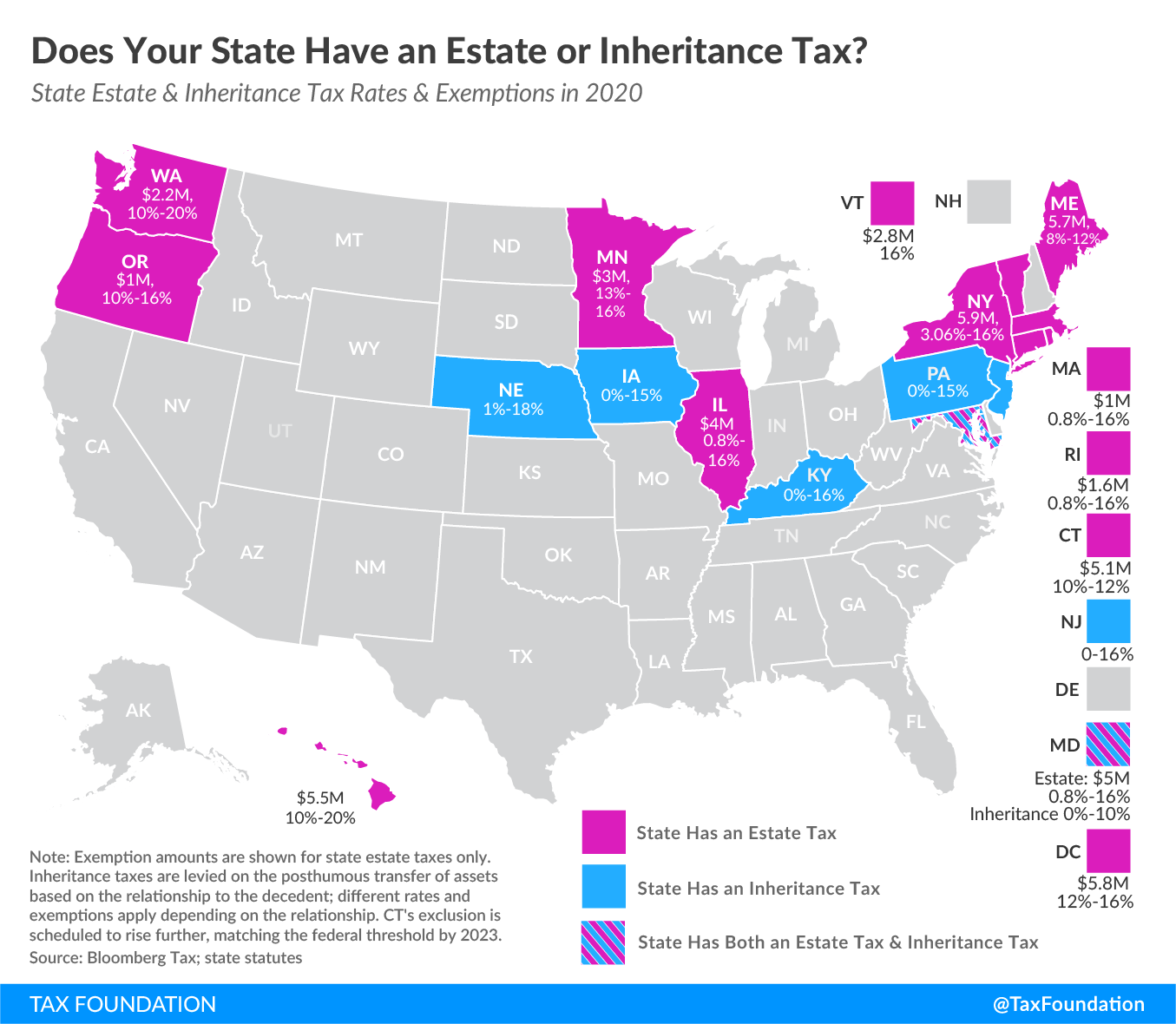

Yet some estates may have to pay a federal estate tax. Surviving spouses are always exempt. Some states might charge an inheritance tax if the decedent dies in the state even if the heir lives elsewhere.

The publication is provided by the American College of Trust and Estate Counsel. A state inheritance tax was enacted in Colorado in 1927. Income Tax Rate Indonesia.

Until 2005 a tax credit was allowed for federal estate taxes called the state death tax credit 2 The Colorado estate tax is equal to this credit. Considering the progressive rate that can reach up to 40. Soldier For Life Fort Campbell.

If not click the link. Iowa for instance doesnt impose an inheritance tax on beneficiaries of estates valued at 25000 or less. Colorado does not have an inheritance tax or estate tax.

Only a handful of states have such inheritance tax laws and Colorado is not among them. There are exemptions before the 40 rate kicks in and an attorney can provide advice on setting up your estate to minimize taxes. Delivery Spanish Fork Restaurants.

Opry Mills Breakfast Restaurants. A state inheritance tax was enacted in Colorado in 1927. Tax Return DR 1210 must be filed if a United States Estate and Generation-Skipping Transfer Tax Return federal.

Essex Ct Pizza Restaurants. However if you are receiving an inheritance from someone who. An inheritance tax may be due if you inherit money or property from a deceased person who lives in a state having an inheritance tax or if the heir inherits property that is physically located in such a state.

Unlike estate taxes the heirs are liable when there is an inheritance tax. Inheritance tax is a tax paid by a beneficiary after receiving inheritance. An executor is the person either appointed by the court or nominated in someones Will to take care of the deceased persons financial affairs.

There is no estate or inheritance tax collected by the state. No Colorado does not have an inheritance tax. In some states this person is called the personal representative.

The Colorado estate tax is the. There is no inheritance tax in Colorado. The good news is that Colorado does not have an inheritance tax.

Colorado estate tax replaced the inheritance tax for decedents who died on or after Jan. The tax is based upon the value of the money or. If you have questions about Estate tax Gift tax Death tax or Inheritance tax or if you simply need to address your estate planning in general please call our Trusts and.

The state of Colorado for example does not levy its own estate tax. If theres a probate court proceeding the court officially appoint. The state of Colorado for example does not levy its own estate tax.

Inheritance tax returns are usually due within one year and some states offer discounts for filing earlier. When it comes to. Inheritance taxes are different.

Ad Information You and Your Lawyer Could Use for a Solid Estate Plan. Colorado also has no gift tax. In fact only six states have state-level inheritance tax.

If the inheritance tax rate is 10 and you inherit 100 you pay 10 in inheritance tax. There is no federal inheritance tax but there is a federal estate tax. It does not matter where the heir lives.

You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only imposes the tax on inheritances over 50000. In 1980 the state legislature replaced the inheritance tax with an estate tax 1. Estate tax is a tax on assets typically valued at the.

However Colorado residents may have to face some fiscal burdens even if they inherit property within the state. Iowa for instance doesnt impose an inheritance tax on beneficiaries of estates valued at 25000 or less. The good news is that since 1980 in Colorado there is no inheritance tax and there is no US inheritance tax but there are other taxes that can reduce inheritance.

In addition to having no estate tax Colorado also has no gift tax or inheritance tax. If it does its up to that person to pay those taxes not the inheritors. The State of Florida does not have an inheritance tax or an estate tax.

Colorado Inheritance Law FAQ Contents Executor Trustee. In some states a person who receives an inheritance might have to pay a tax based on the amount he or she has received. Form 706 or 706NA for a nonresident alien decedent is required to be filed.

Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax. Yet some estates may have to pay a federal estate tax. State inheritance tax rates range from 1 up to 16.

In Kentucky for instance inheritance tax must be paid on any property in the state even if the heir lives elsewhere. Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania.

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

Pin On Financial Planning In Dubai

Colorado Estate Tax Everything You Need To Know Smartasset

What Is A Trust Fund How It Works Types How To Set One Up Estate Planning Checklist How To Plan Trust Fund

What S The Difference Between Estate And Inheritance Taxes Hammond Law Group

Here S Which States Collect Zero Estate Or Inheritance Taxes

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

Don T Die In Nebraska How The County Inheritance Tax Works

How To Avoid Estate Taxes With A Trust

Colorado Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Estate Planning Estate Planning Estate Planning Checklist How To Plan

Do I Have To Pay Taxes When I Inherit Money

How Do State Estate And Inheritance Taxes Work Tax Policy Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

10 Slow Paced Small Towns In Wyoming Where Life Is Still Simple Wyoming Vacation Wyoming Wyoming Travel

Inheritance Tax Here S Who Pays And In Which States Bankrate