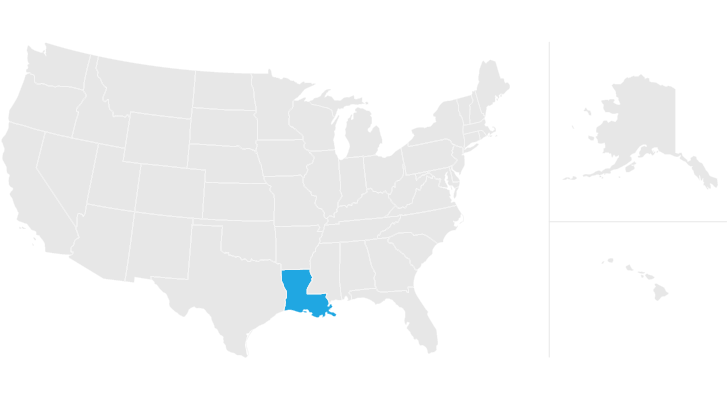

louisiana state inheritance tax

No estate tax or inheritance tax. The state income tax rates for the 2021 tax year range from 20 to 60 and.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

The federal gift tax exemption is 15000 per year for each gift recipient.

. And 4 name an executor to collect the assets of your estate pay any bills. The potential INCOME tax rate on that built in gain even if all of it is classified as a capital gain is 26 20 federal capital gains tax 6 Louisiana top income tax rate. Federal Estate Tax Return Form 706 2 Ratio of assets attributable to Louisiana Louisiana gross estate to federal gross estate per federal return 3 State death tax credit attributable to Louisiana Multiply Line 1 by Line 2 4 Basic inheritance tax From Schedule III 5 Tax reduction under Act 818 of 1997 See instructions.

When a person dies and leaves an inheritance the state must tax the wealth before the beneficiary collects their shares. Louisiana has the fifth lowest property tax. R-3318 1108 1402 Schedule IV Tax Reduction and Determination of Louisiana Estate Transfer Tax 1 Total state death tax credit allowable Per US.

The Economic Growth and Tax Relief Reconciliation Act of 2001 phased out the state estate tax credit between 2002 and 2005 and replaced the credit with a deduction for state estate taxes for deaths that occur. 1 Total state death tax credit allowable Per US. The top inheritance tax rate is 16 percent exemption threshold for class c beneficiaries.

Often in Louisiana one person will inherit. Louisiana no longer has either a state gift tax or a state estate tax. The portion of the state death tax credit allowable to Louisiana that exceeds the inheritance tax due is the state estate transfer tax.

In order to understand Louisiana inheritance law you need to be familiar with the legal terms usufruct and usufructuary. No Act 822 of the 2008 Regular Legislative Session. The federal estate tax exemption is.

The failure to plan for that income tax and the step up on this transaction could be a whopping 32500 200000 75000 125000 and 125000 X 26. Happily I can report they. While the estate is responsible for paying estate taxes beneficiaries must pay inheritance tax.

The portion of the state death tax credit allowable to Louisiana that exceeds the inheritance tax due is the state estate transfer tax. Sales tax in Louisiana runs high. Louisiana requires you to pay taxes if youre a resident or nonresident who receives income from a Louisiana source.

The state taxes any retirement income above 6000. You might inherit 100000 but you would pay an inheritance tax on just 50000 if the state only imposes the tax on inheritances over 50000. Find out when all state tax returns are due.

However according to the federal estate tax law there is no Louisiana inheritance tax. Does Louisiana impose an inheritance tax. Equal to the maximum tax credit for state estate or inheritance tax allowed on the federal estate tax return Pick-up tax Since 2004 federal law allows only a deduction for state inheritance taxes IRC 2058 not a credit But if the Economic Growth and Tax Relief reconciliation Act of 2001 as amended by the 2010.

Effective January 1 2012 no receipts will. With the changes to the Federal Estate tax which took effect this year I have been asked by numerous clients if the Louisiana Inheritance Tax laws were changed in any way. If you own property in Louisiana and pass it on as inheritance then the beneficiary will.

Under the federal estate tax law there is a credit for state death taxes that are paid up to a certain amount. Federal Estate Tax Return Form 706 2 Ratio of assets attributable to Louisiana Louisiana gross estate to federal gross estate per federal return 3 State death tax credit attributable to Louisiana Multiply Line 1 by Line 2. The income tax in Louisiana is progressive and rates range from 2 to 6.

Louisiana Inheritance and Gift Tax. Ad The Leading Online Publisher of National and State-specific Wills Legal Documents. The inheritance could be money or property.

A benefit must be received in order for the tax to be levied. 1 total state death tax credit allowable per us. Bulk Extensions File your clients Individual Corporate and Composite Partnership extension in bulk.

Effective January 1 2012 no receipts will be issued for inheritance tax regardless of the date of death. Louisiana has completely eliminated taxes on any inheritance but for estates that are large enough to require a federal estate tax return there is a Louisiana Estate Transfer Tax. Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

Repealed the inheritance tax law RS. The Economic Growth and Tax Relief Reconciliation Act of 2001 phased out the state estate tax credit between 2002 and 2005 and replaced the credit with a deduction for state estate taxes for deaths that occur. The Act also provided that inheritance taxes due to the state for deaths occurring before July 1 2004 shall be considered due on January 1 2008 if no inheritance tax return was filed before January 1 2008 and the inheritance tax shall prescribe as provided by Louisiana Constitution Article 7 Section 16 in three years from December 31.

See where your state shows up on the board. To State of Louisiana. Make provisions to save estate taxes for larger estates.

Maryland has the dubious distinction of being the only state to collect both an estate and an inheritance tax as of 2021. Inheritance tax laws from other states could in theory apply. As the only state to.

Louisiana Estate Tax Everything You Need To Know Smartasset

Louisiana Estate Tax Everything You Need To Know Smartasset

Pin On What You Didn T Know Til Now

You May Be In A Bit Of A Pickle Punny This Is Us Getting Old

Louisiana Succession Taxes Scott Vicknair Law

Veterans Day Blessing Quote Veterans Day Quotes Veterans Day Veteran

Most Important Documents To Keep In Your Home Safe Will And Testament Inheritance Money Bean Counter

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With Highest And Lowest Sales Tax Rates

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Louisiana Estate Tax Everything You Need To Know Smartasset

A Brief History Of The Estate Tax And Potential Implications For The Upcoming Election Fee Based Wealth Management And Financial Planning

Why Some Americans Should Still Wait To File Their 2020 Taxes

Estate And Gift Taxes 2021 2022 What S New This Year And What You Need To Know Wsj

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

Where Not To Die In 2022 The Greediest Death Tax States

Here S Which States Collect Zero Estate Or Inheritance Taxes

What Is The Difference Between Refundable And Nonrefundable Credits Tax Policy Center